Family Code 2640 and Your Separate Property Downpayment

Family Code 2640 can become a hotly litigated issue in a California divorce

How does Family Code 2640 get your separate property down payment back?

Family Code section 2640 is sometimes litigated in divorce cases. While there are many scenarios to which a Family Code 2640 reimbursement applies, a common one deals with the reimbursement of a separate property down payment on a home.

Here is a typical situation we see.

- The house is purchased during the marriage and a down payment is made.

- One of the spouses uses a separate property source to make the down payment on the home.

- Years later, one of them files for divorce.

What happens to that down payment that was made from a separate source?

How does the spouse who made the down payment from his or her separate source get that money back as part of the divorce?

This scenario comes up often because it is not unusual for a couple who get married to purchase a house shortly after the marriage.

By the same token, the husband and wife often have not been married long enough to have saved community funds (earning or savings acquired during the marriage) to place a down payment on the home.

That means one or both of the spouses may have dipped into their pre-marital savings or used other separate property sources such as the sale or refinance of a premarital home or a monetary gift from family.

There are a lot of different scenarios from where this separate property down payment could be made. In this article, we will discuss what the most common situations are that we have seen.

Family Code 2640 is a property and reimbursement claim

Before we go anywhere, we should look at California Family Code 2640. It is the foundation for recovering a down payment made from a separate source toward a home purchased during the marriage.

Family Code section 2640 states:

(a) "Contributions to the acquisition of property," as used in this section, include downpayments, payments for improvements, and payments that reduce the principal of a loan used to finance the purchase or improvement of the property but do not include payments of interest on the loan or payments made for maintenance, insurance, or taxation of the property.

So, right out of the gate, section 2640 gives you some parameters of what it does and does not include. By the way, don't assume that is all it includes and does not include. The statute has been interpreted by California Appellate and Supreme Court cases and, like any statute, it sometimes stretches its reach and scope beyond just what it states in black and white. Back to the Code…

(b) In the division of the community estate under this division, unless a party has made a written waiver of the right to reimbursement or has signed a writing that has the effect of a waiver, the party shall be reimbursed for the party's contributions to the acquisition of property of the community property estate to the extent the party traces the contributions to a separate property source. The amount reimbursed shall be without interest or adjustment for change in monetary values and may not exceed the net value of the property at the time of the division.

Self-explanatory? A little bit. The issue of waiver can get really complex. It is beyond the scope of this article but we will discuss it in a future article. Let's keep reading.

(c) A party shall be reimbursed for the party's separate property contributions to the acquisition of property of the other spouse's separate property estate during the marriage, unless there has been a transmutation in writing pursuant to Chapter 5 (commencing with Section 850) of Part 2 of Division 4, or a written waiver of the right to reimbursement. The amount reimbursed shall be without interest or adjustment for change in monetary values and may not exceed the net value of the property at the time of the division.

This part deals with separate property contributions to the acquisition of property of the other spouse's separate property estate. We are not talking about that in this article so let's skip subsection c. We are dealing with recovering the down payment from a piece of community property real estate.

Recovering the separate property down payment pursuant to Family Code 2640 is usually a three step process

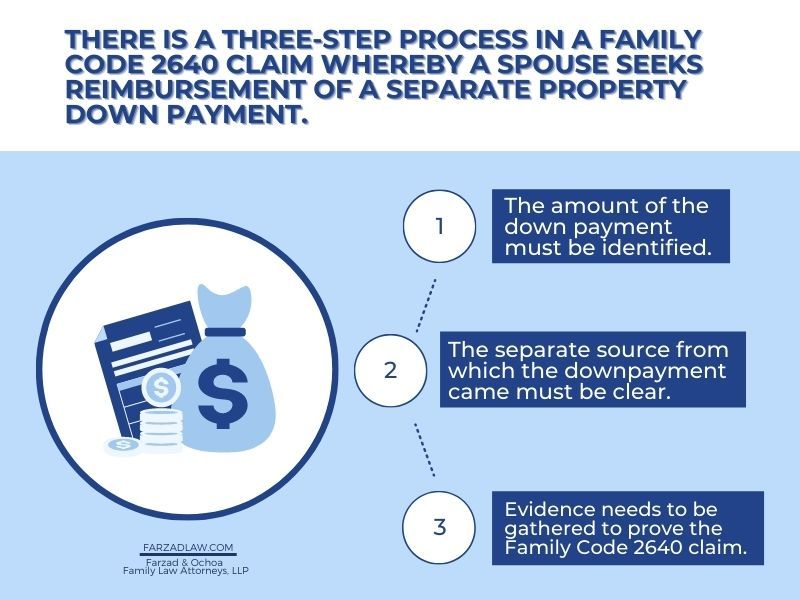

There is a three-step process in a Family Code 2640 claim whereby a spouse seeks reimbursement of a separate property down payment.

First, the amount of the down payment must be identified.

Second the separate source from which the down payment came must be clear.

This is typically from the sale of another property that was owned prior to the marriage, money in a liquid account, such as a bank or investment account that one spouse had prior to the marriage, or a gift from a third person such as a family member to one spouse during the marriage.

This gift will typically come from a father and mother to the spouse who made the down payment.

Third, evidence needs to be gathered to prove the Family Code 2640 claim. Specifically, evidence will be needed to show the amount of the down payment as well as a tracing of it to a separate property source.

How do you do this? There are several ways but we will go over the most common ones here.

Tracing the Family Code 2640 claim both backward and forward

First, you can work backward. If you look at your escrow paperwork from the purchase of the house toward which you made a separate property down payment, it should identify the amount of the down payment made from the separate property source. If you cannot locate the escrow documents, issuing a subpoena for it during the divorce case will be important.

Not all escrow companies will keep documents for an extended period of time. Issuing a subpoena early on in the case may increase your chance of obtaining the information you seek.

Once you have the escrow documents, look at the down payment amount.

You can from there work backwards to show the amount of the down payment that was made from the separate property proceeds. If it came from a bank account, you can obtain the bank statement.

If it came from the sale of a home or money borrowed from a premarital home, trace the down payment backward to the account from where that money was paid.

No matter how you do it, once you have identified the down payment, working backward to identify the separate source (as far back as you can go until you get to the source) will give you a greater chance to prove your Family Code 2640 reimbursement and property claim to the down payment.

But what if you cannot find the escrow paperwork that relates to the purchase of the home? Can you still show the 2640 claim?

Sure.

For example, if you sold a property that you owned prior to the marriage, obtaining the sale documents that show how much was received from that and then tracing that information forward toward a deposit into a bank account and then doing further tracing to show that the money from the bank account was used to pay the escrow company or otherwise for the purchase of the community house during the marriage will help you connect the dots between the sale of the premarital separate property asset through the down payment of the residence purchase during the marriage.

Remember this is just one scenario. There are many.

What happens in a situation where the separate property down payment source and the Family Code 2640 reimbursement claim is from a gift?

This often happens with family or close friends. We have also seen it with business partners. Let's say a $150,000.00 down payment is made on the home and the money came from a third person to you. How do you show you have a Family Code 2640 claim to get that money back?

First, you should obtain from the person, ideally with the help of your family law attorney, a signed declaration under oath that clearly identifies the money as a gift to you.

You would also ideally have a paper trail of the money to show it was truly a gift as opposed to money funneled from you to the person and back to you, or a loan that was repaid by the community (which may complicate things further).

If the money came from a bank account, account statements will be helpful. Unless you don't have a choice, it is better to prove your case with testimony and paperwork as opposed to just testimony.

While very strict record keeping is not absolutely necessary to win every Family Code 2640 reimbursement claim, it certainly helps if you have your paperwork in order. Showing a tracing of a 2640 reimbursement claim gets harder without a paper-trail.

How do you get paid your Family Code 2640 reimbursement claim?

So let's assume you were able to show that you have a 2640 reimbursement claim to a specific piece of real estate, such as a home. How do you get your money?

Here is an example.

Let's say the home was purchased for $500,000.00. Let's further say that the separate property Family Code 2640 down payment was proven to be $100,000.00, which was the entire down payment of the home. Let's say, today, the house is worth $800,000.00 and that is what the house sells for, the loan on the house is $400,000.00, leaving an equity of $400,000.00. Let's also assume everything other than the $100,000.00 is community property.

Make sense? Here is how it works:

- The house is sold for $800,000.00

- $400,000.00 goes to the bank

- Of the $400,000.00 equity that remains, $100,000.00 is paid to the spouse who had the Family Code 2640 reimbursement claim

- The remaining $300,000.00 that is community property is divided 50/50.

Family Code 2640 can cover a lot of different scenarios. We hope you found this article as a good start to understanding its basic parameters as it relates to down payment from a separate source toward a piece of community real estate.

Reimbursement claims are far too complex to rely on any article, even one as well written as this one, if we do say so ourselves. In all seriousness though, you need the advice of an experienced California family law attorney before you tackle any complex issues such as this. We have just scratched the surface of this rule.

There are issues of waiver of the Family Code 2640 reimbursement right, transmutation (I know, you are thinking "transmute a what?"), the year the home was acquired may be an issue if it predates the passage of the statute, the right being a property right versus one personally against the other spouse, and other complexities can create layers of necessary information you need before you make a section 2640 claim or defend against one.

Family Code 2640 is not even limited to real estate. It applies to different types of properties, under various scenarios.

Hey, that is why we are here. Give our divorce lawyers a call.

For some more general reading on dividing assets in a California divorce, check out our property page. And since Family Code 2640 claims sometimes tag along with Moore Marsden claims in California, check out the informative article we wrote on that topic.

Your Strategy Session

About your strategy session

Southern California Offices

Locations

Our Services and Fees

Frequently asked questions

Strategy sessions are designed for the serious client. This is your money & your future financial security. That is why we are intense and result-focused, and why you should be too.