Are California Alimony Calculators Trustworthy?

A California alimony calculator is not helpful when it leads you down the wrong path

California alimony calculators have gained popularity within the online legal community. Many lawyers feature these calculators on their websites, with some suggesting that users can determine their own alimony amounts. But after reading all the disclaimers that come with these calculators, you may wonder if they are truly reliable. In this article, we'll address that question and show you how to properly calculate alimony without taking foolish shortcuts.

A California Alimony Calculator Is Not as Reliable as You Think

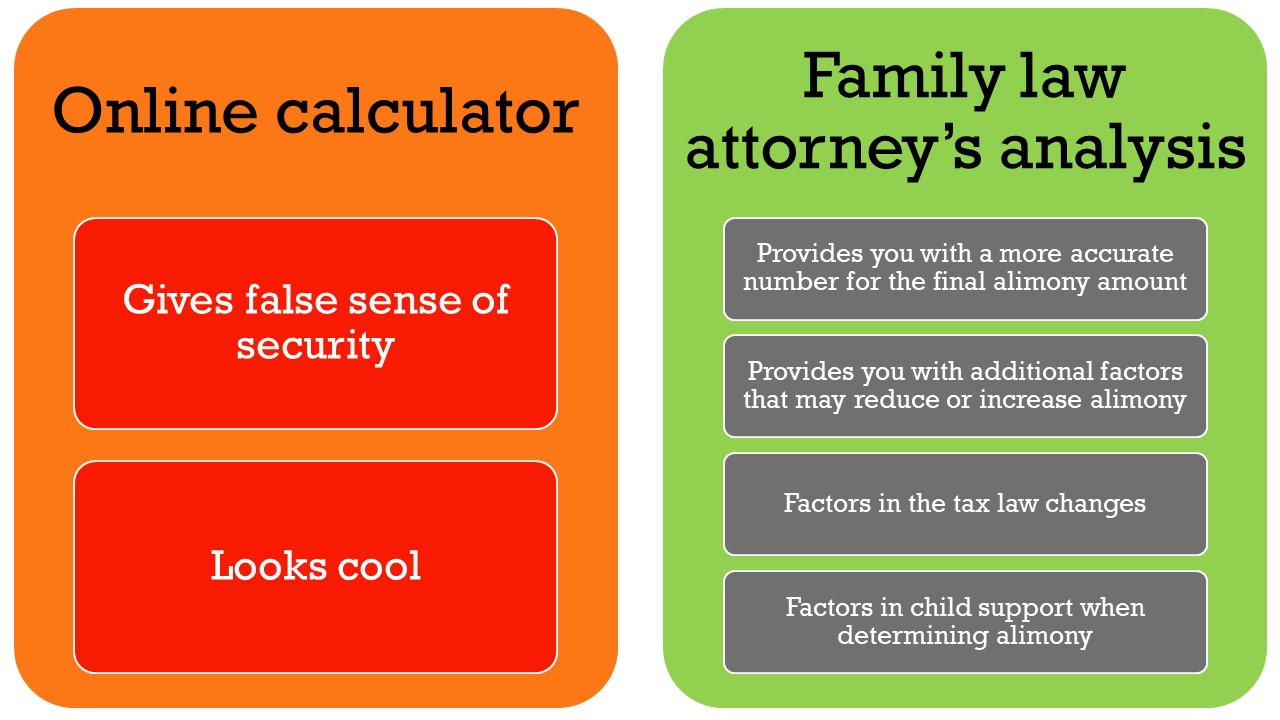

Our family law firm considered adding a California alimony calculator to our website but ultimately decided against it. While such a calculator might "look cool" and provide a broad ballpark figure for temporary alimony, we believe there's a much better approach.

We're not discouraging you from using an online California alimony calculator if you wish to do so. Instead, we want to provide our perspective: it's wiser to have a real strategy session with an experienced family law attorney. In such a session, you'll receive real numbers that are carefully constructed and, therefore, more reliable. We'll explain why in this article.

After reading this article, be sure to check out our informative guide on California alimony laws.

Note: Nothing in this article is legal advice and should not be construed as such.

The Court Sometimes Uses a Computer Program to Determine Temporary Alimony

The key word here is temporary alimony. There is a big difference between temporary alimony and the final alimony amount. Even the term "final" alimony should be taken with a grain of salt because alimony is usually modifiable after a divorce judgment.

Neither an alimony calculator nor the computer programs used by courts and lawyers are particularly helpful for determining alimony at the judgment phase. California law generally prohibits judges from relying on any computer program to determine alimony amounts, except for temporary alimony.

Some lawyers still use these programs to estimate the final alimony number. Is that wise? It depends. If used by an experienced family law attorney who knows what they are doing, it may provide a range of potential numbers. But this requires program tweaking—something that online California alimony calculators generally cannot do.

Why a California Alimony Calculator May Give You the Wrong Number

Do you have children? Have you considered how much your child support will be? Child support depends largely on parenting time, which in turn impacts disposable income. The higher the child support amount, the less disposable income is available to pay alimony temporarily.

Trying to calculate temporary alimony without knowing your child support obligations is almost pointless. A California alimony calculator that doesn't take child support into account may give you a significantly inaccurate number.

Does the Online Calculator Account for the Proper Tax Basis?

California spousal support laws have changed significantly following the passage of the Tax Cuts and Jobs Act. This Act eliminated the taxability of alimony for the receiving spouse and the tax deduction for the paying spouse for divorce agreements executed after December 31, 2018.

- Does the California alimony calculator account for these new tax settings?

- If not, do you realize how significantly inaccurate the alimony calculator's number may be?

Who Will Pay the Expenses, Separate from Alimony?

If you expect to pay alimony, what other expenses do you and your spouse have? For example, is your spouse a homemaker? Will they continue to live in the marital home while you move out? Who will pay the mortgage? Who will make the car payments?

Until you answer these questions, relying on a California alimony calculator is like walking blindfolded. If you commit to significant expenses and alimony on top of that, you may quickly find yourself unable to sustain either.

Check out our article on how to avoid paying alimony that is too much and for too long.

We also wrote an article for dads on the 5 dumb mistakes dads make during a divorce. If you are a father going through a divorce, it is a must-read.

What About the Homemaker or Lower Income Earner?

Are you the homemaker or lower income earner expecting to receive alimony? Have you considered whether the alimony amount will be sufficient to maintain your standard of living? Or would it be smarter to have your higher-earning spouse cover household expenses instead of paying alimony temporarily? Until you consult with an experienced family law attorney, these answers won't come easy.

You will benefit from reading our article on how long alimony is supposed to last.

What If the Post-Separation Income Exceeds the Marital Standard of Living?

What was the marital standard of living? What if it was based on an average income during the marriage, but post-separation, the incomes are completely different?

For example, let's say the marital lifestyle was built on a combined income of $100,000 annually. Now, after separation, the wife earns $150,000 annually, and the husband earns $50,000. Should the wife pay alimony based on her new income? Probably not, because the marital standard of living wasn't built on a $200,000 annual income. This is where a California alimony calculator falls short.

We wrote a helpful article titled, how long do you have to be married to get alimony?

Alimony should not provide a windfall after separation simply because one spouse earns more post-separation than they did during the marriage. Unlike child support, alimony should not adjust upward as income rises beyond the marital standard of living.

Relying on a California Alimony Calculator Is Often a Bad Idea

There are numerous scenarios where relying on an online California alimony calculator can be unwise. These calculators can leave you in a poor financial position, whether you are a higher or lower-income earner.

This article aims to make you think critically before placing your trust in one of these calculators. And if you still choose to use one, remember it's no substitute for a consultation with an experienced attorney.

Let's Talk About Your Situation and Provide You with Helpful Legal Advice

We encourage you to schedule a consultation with us to get accurate and smart calculations. As one of the largest and most respected family law firms in Southern California, we are highly experienced and committed to obtaining the best results for our clients.

Every case is unique and should be evaluated on its own facts. Our firm's extensive experience and dedication set us apart, and we're ready to put our expertise to work for you. Contact us for an affordable strategy session, and we'll show you exactly what we mean.

Want to learn more about California alimony? We provide helpful article links below.